The Core Role of Optical Films in LCD Modules

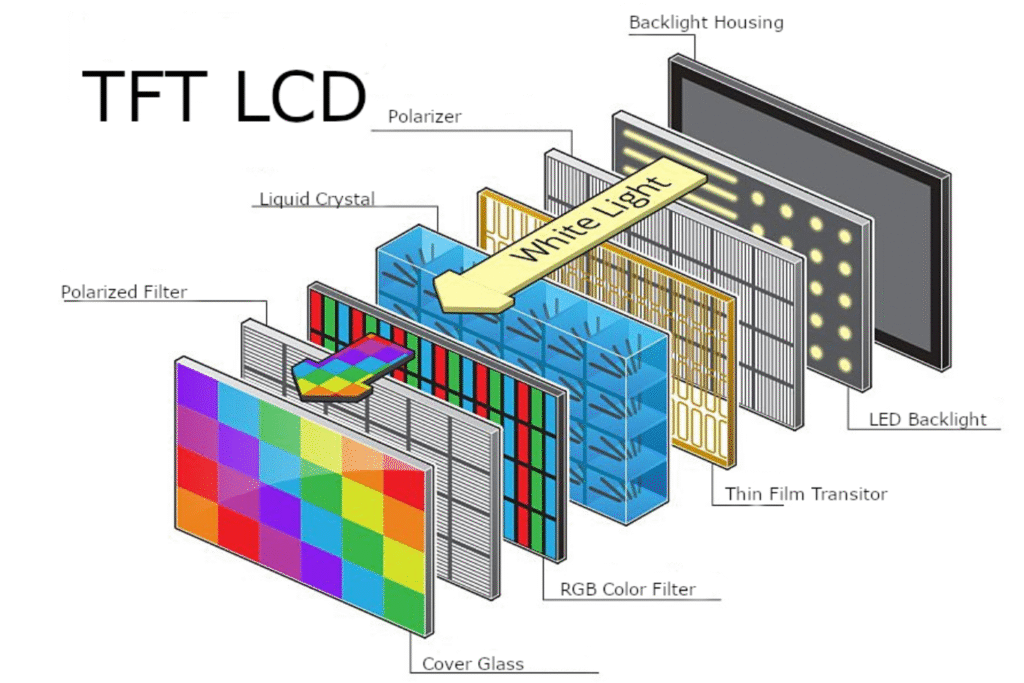

Liquid crystal modules (LCMs) typically consist of two parts: the liquid crystal panel and the LED backlight module. Since liquid crystals themselves do not emit light, they rely on the LED backlight module to provide illumination for display functionality.

The backlight module primarily comprises a light source (CCFL or LED), reflective film, light guide plate (LGP), diffusion film, brightness enhancement film (BEF), and an outer frame. Its fundamental principle involves converting point or line light sources into high-brightness, uniform area light sources through optical films, thereby enhancing luminous efficiency.

Driven by industry demands for cost reduction and structural simplification, the market has introduced microlens films combining diffusion and brightness enhancement functions, alongside dual brightness enhancement films (DBEF) offering superior brightness effects. These innovations cater to diverse LCD module design requirements.

Optical films account for a significant portion of the cost structure. For example, in a 42-inch LED TV, optical films constitute 37% of the led backlight module cost, while the backlight module itself represents 47% of the LCD module cost. This translates to optical films accounting for approximately 17% of the total LCD module cost, underscoring their critical importance.

Global LCD Module Market Demand Continues to Grow

According to Omdia data, global shipments of large-size LCD panels are projected to reach 875.5 million units by 2025, representing a year-on-year growth of approximately 2.4%. Demand for LCD modules primarily centers on consumer electronics sectors such as LCD TVs, monitors, laptops, and smartphones.

Driven by display technology upgrades and the widespread adoption of high-resolution, low-power screens, global demand for LCD modules will maintain steady growth.

Synchronous Expansion of the Optical Film Market

As a critical component of LCD modules, the optical film market is closely intertwined with the module market. According to a Data Insights Market report, the global market size for optical films used in backlight modules reached approximately $6.5 billion in 2024 and is projected to grow to $7.5 billion by 2033, with an average annual growth rate of about 2.2%.

Demand for various optical films is as follows:

Reflective Film: 184 million square meters

Diffusion Film: 184 million square meters

Brightening Film: 204 million square meters

Micro-Lens Optical Film: 76 million square meters

Dual Brightening Film: 71 million square meters

This growth stems not only from LCD capacity expansion but also aligns closely with end-product demands for slim profiles, high brightness, and energy efficiency.

Chinese Market Offers Vast Potential

1. China’s Rising Position in the LCD Industry Chain

China has become a major global producer and consumer of consumer electronics such as LCD televisions, computers, and smartphones. According to data from the Ministry of Industry and Information Technology, China’s electronics industry accounts for over 50% of global IT spending, with production volumes of hardware products like televisions, computers, and mobile phones exceeding half of the world’s total. China leads globally in demand for certain end products.

2. Accelerated Shift of LCD Production Capacity to China

Historically, the LCD industry was concentrated in Japan, South Korea, and Taiwan. However, since the 1990s, driven by robust domestic demand, significant labor cost advantages, and supportive national policies, global LCD panel and module production lines have progressively relocated to mainland China. Currently, China’s LCD panel production capacity has surpassed Japan’s, ranking third globally, with continued growth.

International panel giants like Samsung, LG, AUO, and Sharp have established module production bases in China, while domestic manufacturers such as BOE, TCL, Tianma, and Longteng Optoelectronics are actively building high-generation panel production lines.

3. Opportunities for China’s Optical Film Industry

For years, advanced optical film technologies were dominated by Japanese, Korean, and American companies—including Japan’s Nitto Denko and Toray, South Korea’s SKC, and the U.S.’s 3M—which controlled the majority of the global market share.

In recent years, backed by national policies, Chinese enterprises have achieved breakthroughs in optical film technology. Some products now rival international standards in performance. Leveraging advantages like high cost-effectiveness and rapid delivery, these domestic manufacturers are gradually replacing imports and becoming suppliers for renowned global brands.

According to JX WiseVision analysis, global demand for TFT-LCD modules is projected to reach 850 million units by 2025, with China’s production capacity accounting for over 50% of this total. This further solidifies China’s position within the global LCD supply chain and presents significant market opportunities for domestic optical film manufacturers.

Conclusion

Optical films serve as core components in LCD backlight modules, significantly impacting display performance and cost structures. Global LCD module demand maintains steady growth, driving sustained expansion in optical film requirements.

China’s rising prominence in the LCD supply chain accelerates domestic production of optical films, presenting broad market prospects.

Looking for customized lcd optical films and backlight solutions?

We specializes in light guide plates, diffusion films, brightness enhancement films(Prism film), reflective films, and LED backlight module solutions, widely applied in LCD displays, industrial equipment, lighting, and consumer electronics.Contact us for customized optical solutions !

Customized Backlight Solutions & Optical Sheets Supplier – Rnoda Tech

Customized Backlight Solutions & Optical Sheets Supplier – Rnoda Tech